Having a prepaid card is a convenient way to pay for products and services, whether in-store or online. Instead of carrying cash around, you just load your money on your prepaid debit card, making it safer and more practical.

You can also get your paycheck and government benefits on your prepaid card.

If you’re more into cryptocurrency, you can use the Bitcoin IRA, just like other available IRAs to receive your retirement benefits. We recommend the Bitcoin IRA review for proper guidance with this.

With so many of us using prepaid cards, one commonly asked question is how to transfer money from a prepaid card to a savings or checking account?

The first step in the process is to check if your card even allows you to transfer funds to your bank account in the first place.

Can You Transfer Money From A Prepaid Card To A Bank Account?

Yes. You can transfer money from a prepaid card to a bank account in almost all cases. But how you do it depends on what type of prepaid card you have.

There are two types of prepaid cards:

Which One Do You Have?

Prepaid Debit Card

This is a card that can be used anywhere that credit/debit cards are accepted. If you have used your prepaid card at different places with no trouble, then you have a regular prepaid card.

How to get money off your card? Follow these specific instructions if you have any of these cards: American Express Bluebird Card, Green Dot prepaid card, Netspend prepaid card, Key2Benefits prepaid card.

If you don’t see your card there, you can still use three methods to get your money through MoneyGram, PayPal and USPS Money Order.

Prepaid Gift Card

This type of card limits you to purchasing products and services from participating merchants, e.g., Home Depot.

How to get money off your card?We’ve found that one way to get money off a gift card is to use a service like Raise.

Method 1: How To Transfer Money From Your Prepaid Card To Your Bank Account Using MoneyGram

We struggled to find a simple, sure-fire way to move funds off our prepaid cards for a long time. One day, a helpful reader shared this clever hack that works with almost every prepaid card.

Using a remittance service like MoneyGram, you can transfer money to your bank account quickly, cheaply and safely.

Update: We’ve heard that not everyone can find the Account Deposit / Debit Card Deposit option in MoneyGram. If that’s the case, you can still use the PayPal or USPS methods we talk about below.

Here Are Some Reasons Why We Love This Method:

✅ Safe: MoneyGram has been around since 1940, and is the second largest money transfer company in the world.

✅ Fast: Receive your money in minutes if you choose the Debit Card Deposit option.

✅ Cheap: Fees are as low as $1.99. See our section on how their fees are calculated.

✅ Reliable: Dozens of our readers have successfully used this method, and it appears to work for virtually any prepaid card.

Here are the steps to transfer money from your prepaid card to your bank account using MoneyGram:

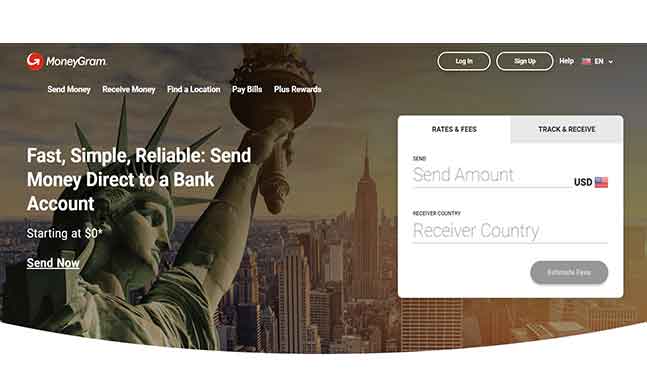

Step 1: Sign Up For An Account At MoneyGram.Com

Go to the MoneyGram website and click “Sign Up” to create an account using your email address. You may have to provide some photo ID to verify that you’re a legitimate person.

Step 2: Navigate To The ‘Send Money’ Page And Fill Out Payment Info

Once you’re signed up, click on the “Send Money” option in the menu. You should see a page like in the screenshot above.

On this page:

- Enter the amount that you want to send

- Select Debit/Credit Card

- Select the ‘Account Deposit’ option (or the ‘Debit Card Deposit’ option if you don’t see the ‘Account Deposit’ option. This will require that you have a debit card linked to the bank account you’re sending money to.

Step 3: Complete Your Bank Details

After clicking next, you’ll be taken to a page like in the screenshot above. Enter your Receiver’s details. This will be information like your name, address and account/debit card info.

Click ‘Next’. According to the MoneyGram website, many account deposits are completed within minutes, subject to banking hours and systems availability.

How Much Does It Cost?

You’ll pay a fee based on the amount you are sending. For amounts less than $200, MoneyGram charges you a base fee of $1.99. For amounts above $200, it charges $1.99 + 1% of the transferred amount.

For example, if you’re going to send $500, the fee will be $1.99 + $5, for a total of $6.99.

You can estimate the fee before you send the money by using the fee calculator on the MoneyGram homepage.

How To Save On The Transfer Fee?

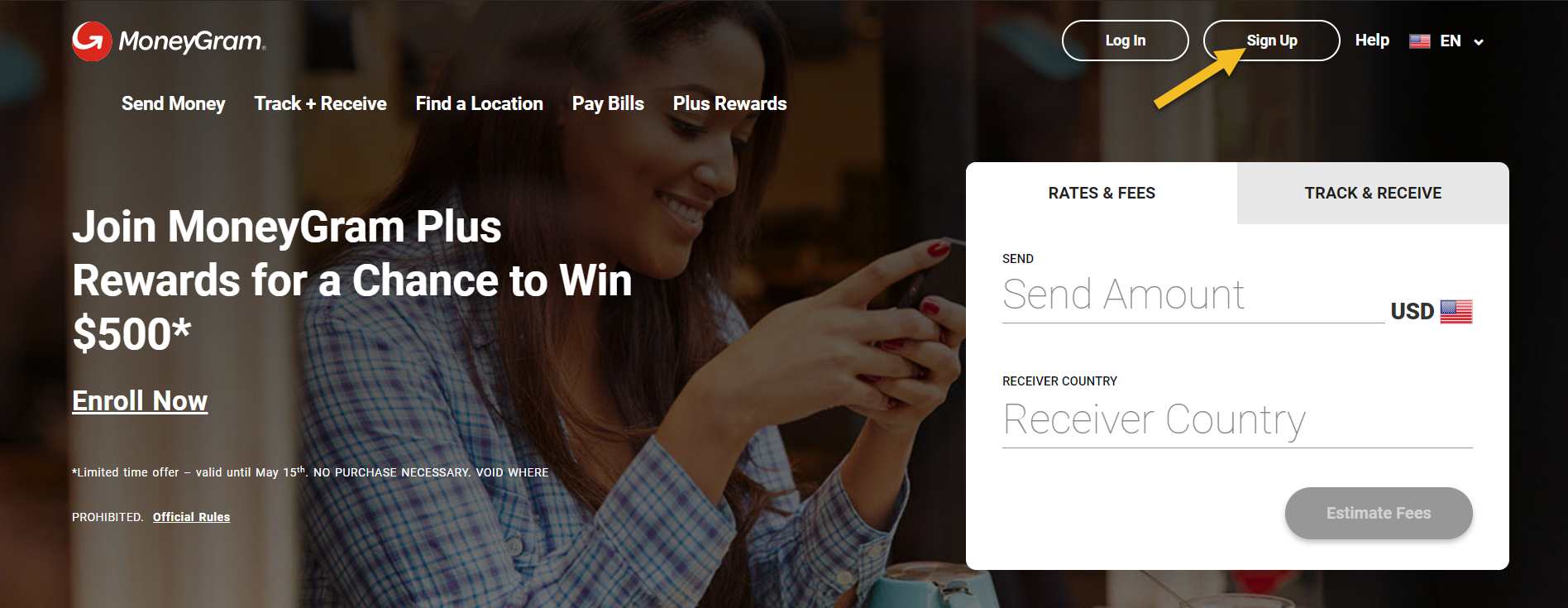

If you are going to use this service regularly, you can save on fees by enrolling in the MoneyGram Plus Rewards.

With this program, you will save 20% on fees on your second transfer and 40% OFF on fees every fifth transfer.

If you’re transferring a large amount, then taking advantage of the MoneyGram Plus Rewards program will save you lots of money!

Is There A Limit When Transferring Money Using MoneyGram?

The limit for sending money online is $10,000 per transaction and up to $10,000 every 30 calendar days.

If you need to send more funds, you’ll have to do it in person at one of the MoneyGram agent locations, however, according to the MoneyGram FAQ, most agent locations only accept cash.

How Long Does It Take To Transfer Money With MoneyGram?

All of MoneyGram’s transactions occur within the same day, including prepaid card transfers to your bank account.

Ready to get your money off your prepaid card? Visit the MoneyGram Website to get started.

Method 2: How To Transfer Money From Your Prepaid Card to Your Bank Account Via PayPal

You can send the money inside your prepaid card to your personal PayPal account. PayPal will charge you a minimal fee, but the process is easy and you can do it all online.

Step 1: Create a PayPal account.

If you don’t have an account yet, you can create one for free on the PayPal website.

You’ll need to provide the following:

- Full name

- Address

- Phone number

- A valid ID

After completing your application, it only takes a few minutes for your account to be approved and activated.

Step 2: Link your prepaid card AND an active bank account to your PayPal account.

Next, link your prepaid card account to your PayPal. This will allow you to send money from your card to your PayPal account.

You also need to link an active bank account, a debit card, or a credit card to your account. This is where you will withdraw the money you receive from your prepaid card.

To link to your bank account, follow these steps:

- Log in to your PayPal account.

- Click on “Wallet.”

- Choose “Link a Card” or “Link a Bank” depending on the type of account you have.

- Enter the required information and finish the verification process.

To link your prepaid card, follow these steps:

- Log in to your PayPal account.

- Click on “Wallet.”

- Choose “Link a Bank Account.”

- In the bank details field, type in some random letters and hit enter. This will prompt you to enter the prepaid card details manually.

- Type in the account number and routing number on your prepaid card.

- Link by clicking “Agree.”

- Don’t click on “Confirm Instantly.” This will require you to log into your personal bank account to confirm the transfer.

- Instead, click on “Request Deposits” and wait for your request to be approved by PayPal. This will allow you to transfer money from your prepaid card to your PayPal account.

- Wait for approval. PayPal will send test charges to your card and bank account. This will be refunded.

Once you get a notification that the charges were approved, you can then send money from your prepaid card to PayPal.

Step 3: Transfer money from a prepaid card to your PayPal and bank account.

Now you’re ready to transfer money from your prepaid card to PayPal and your bank account:

- Log in to your PayPal account.

- Click on “Wallet.”

- Choose “Send Money,” then, “Add Money Online.”

- Choose your link prepaid card as the source of funds.

- Fill in the amount to transfer, then complete the transaction.

The amount should be credited instantly to your PayPal account.

After this, you can transfer the amount in your PayPal account to your bank account so you can withdraw it in cash.

Fees:

- It’s free if you use the regular transfer option. However, this will take 3 to 5 business days.

- PayPal will charge you 1% of the total amount if you choose the instant transfer option.

Method 3: How To Transfer Money From Your Prepaid Card to Your Bank Account Via USPS Money Order

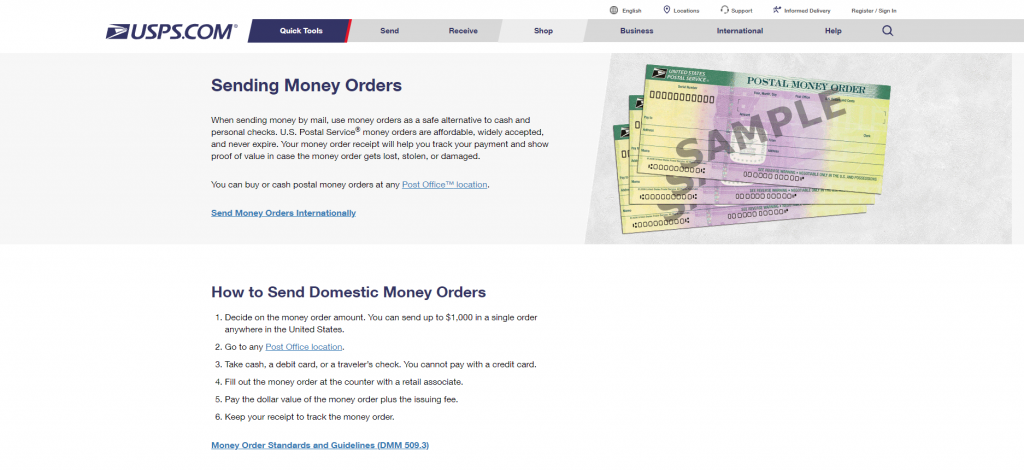

You can also transfer money from your prepaid card to your bank account using a US Postal Money Order.

Unlike the PayPal method, you’ll need to go to the Post Office, so make sure you look up the address and confirm their policies in your area.

Here are the steps:

- Go to your local post office.

- Purchase a US Postal Money Order using the balance on your gift card.

- Endorse the money order to yourself. Make sure to fill in all the necessary information, including your name and address.

- Go to your bank to cash it out or to deposit it into your account.

- Some post offices can also cash out the money order for you as long as they have enough cash on hand.

Fees:

- $1.45 for USPS money order up to $500

- $1.95 for USPS money order $501 to $1,000

Popular Prepaid Cards That Allow Transfers To Bank Accounts (With Instructions)

We get many queries about transferring funds from prepaid cards to bank accounts. So we’re able to see which cards most people need help with.

Here’s a list of common prepaid cards in the US and their exact instructions on how to transfer from the prepaid card to your bank account.

American Express Bluebird Prepaid Card

The American Express Bluebird card is a prepaid debit card that has no monthly or annual fees, no overdraft fees, no foreign transaction fees, and free ATM use.

The card can be used to pay bills online or via a mobile device and can be loaded with direct deposit, cash load at Walmart, mobile check deposit, and by using a debit or credit card.

The card is issued by American Express and serves as an alternative checking account for those who have been denied by traditional banks.

Bluebird prepaid cardholders can also transfer money from Bluebird to a linked savings or checking account via these steps:

- Log into your Bluebird Account.

- If you already have a linked bank account, it will already be displayed on the dashboard.

- If it’s your first time linking a new bank account, fill in your routing and account number.

- Wait for Bluebird to send two trial deposits to verify the account. This can take up to five business days, but you only need to do it once. After your card is verified, you can transfer money to it anytime.

- Navigate to the “Money Out” section.

- Click “Transfer to Bank.”

- Select the bank account you’ll be transferring to.

- Confirm the transaction.

- It’ll take two to four business days for the money to reflect in your bank account.

Key2Benefits Prepaid Card

If you have a Key2Benefits Prepaid Card, you can transfer some or all of your balance to your personal savings or checking account. You need to have the Routing Number and Account Number of the bank account you wish to transfer into for you to complete the transaction.

- Log-in to Key2Benefits.com

- Click on “Card to Account Transfer” in the left-hand menu.

- The Card to Account Transfer screen will appear.

- Type in the amount you wish to transfer.

- Type in your Routing Number.

- Type in your Account Number.

- Choose the Account Type.

- Enter the security code you see on your screen to verify this is a valid request.

- Click “Continue”

- Verify your information.

- Click “Submit”.

Green Dot Prepaid Visa Card

Green Dot Prepaid Visa Card is a prepaid debit card that you can use to make purchases, pay bills and get cash. They have different cards depending on your needs, including one specifically for teens.

Green Dot Prepaid Visa Cards are only sold in stores.

You can transfer money from your Green Dot prepaid card to other bank accounts, subject to the receiving bank’s limitations and guidelines.

To transfer money from your Green Dot prepaid card to another Green Dot card or an external bank account, follow these instructions:

- Log in online to your Green Dot card account.

- Select transfer money.

- Choose a linked bank account or add the bank details of the receiving account.

- Follow the on-screen instructions and confirm.

- Green Dot to Green Dot transfers reflect immediately, while transfer to other banks may take up to three business days.

Netspend Prepaid Card (Visa, MasterCard, Skylight ONE)

A Netspend Prepaid Card will allow you to move money to your bank account, as well as to other Netspend cardholders. To transfer funds to your bank account:

- Go to the Netspend Online Account Center

- Sign-up for an account and follow instructions to link your bank account.

- Fees for bank transfers will be determined by the bank.

Note that this service may not be available for some banks. You have to check with the bank if this is available if you run into any issues.

Other Visa Prepaid Cards

If you have a Visa Prepaid Card, the process of how to transfer money to your bank account will depend on the type of card you have.

To transfer a visa prepaid to a bank account, you have to check with your prepaid card provider if this service is available.

Go to this link to find your prepaid card and visit the corresponding website: https://usa.visa.com/pay-with-visa/find-card/get-prepaid-card. (Note: at the time of writing, we couldn’t find a money transfer feature for Visa prepaid cards like smiONE, ACE Cash Express, MyVanilla, and One VIP. So you should use either the MoneyGram, PayPal or USPS method for these cards. )

Here’s the process to go through if you have a prepaid debit card that was not listed above.

How To Transfer Money From Prepaid Card To Bank Account (For Cards not Listed Above)

The process is slightly different depending on each prepaid card but here’s a step-by-step guide that should apply to most cards:

Step 1: Find Out If Your Prepaid Card Can Be Used Anywhere, Or Is Limited To Participating Merchants Only

Visit your prepaid card company’s website and look at the card’s features. Can it be used anywhere that regular debit cards are accepted?

For example, certain cards have the following features:

The Card can be used to purchase merchandise and services anywhere Visa debit cards are accepted in the United States.

However, other cards are only limited to participating merchants:

Your Card can be used to purchase merchandise and services at any grocery store, specialty foods store, food truck, or online food retailer in the US where Visa debit cards are accepted.

If your card can be used anywhere in the US (the first type of card), then you can move on to step two. Otherwise, read our section on transferring gift card balances to your bank account.

Step 2: Visit Your Prepaid Card’s Website To See If They Offer Transfers To A Bank Account

Some prepaid card companies help you do transfers to your bank account through their website or app. So your first stop should be the website of your prepaid card provider.

Check Your Card Company’s FAQ Page

Here, they’ll usually have a FAQ (Frequently Asked Questions) page. If your card company allows transfers, they’ll state it very clearly.

For example, the Bank of America CashPay card says the following on their FAQ page:

“…you may perform an Online Funds Transfer via the CashPay Customer Service website at www.bankofamerica.com/cashpay (fee will apply) to transfer funds from your CashPay account to a traditional checking or savings account owned by you in the United States.”

Not in the FAQ? Check Your Card Company’s Features Page

If you don’t find it on your card provider’s FAQ page, check the features and benefits page of your prepaid card.

On the Netspend website, this information appears on the ‘Card Benefits’ page:

“Have a bank account in addition to your Netspend Card Account? Link your financial accounts from participating bank accounts and you can transfer money between them and your Netspend Card Account.”

If your prepaid card company offers transfers to your bank account, then carry on to the next step. If it’s not clearly stated, then your best bet would be to use the PayPal method or the USPS money order method.

Step 3: Register Or Log-In To Your Prepaid Card Account

After finding out whether your prepaid card provider allows such a transaction, you can sign-up for an account or log in if you already have an account.

If you need to do registration, then you will need your prepaid card with you. After signing up, you can use the login details for future transactions.

Step 4: Link Your Bank Account To The Prepaid Card By Providing The Routing Number And Account Number Of Your Bank Account

To perform the transfer, most prepaid card providers will ask you to link your bank account by entering your bank account’s routing number and account number.

Your routing number is a 9-digit number that tells you where your bank account was opened. One place to search for it is at the bottom of your checkbook.

It’s also known as your ABA or RTN number.

Make sure you have this ready. If you don’t have the routing number of your bank account, check with your bank’s website.

Most banks have a page where all their routing numbers are listed. Have a look at the U.S. Bank’s website for example.

Step 5: Follow Additional Instructions From The Prepaid Card Company And Perform The Transfer Online To Your Bank Account

Every prepaid card provider will have a slightly different set of instructions so make sure to follow them carefully.

At any point, if you’re unsure of what to do, your prepaid card provider should have a customer service hotline that you can call for help. Here’s an example of the detailed instructions provided by the Key2Benefits Prepaid Card website.

How Long Will It Take For The Money To Be Transferred To My Bank Account?

How long the transaction takes depends on your bank. Some transfers can be completed within a few hours or on the same business day.

For most banks, though, it usually takes a few business days before you see the money in your account.

This is because you must create a new “transfer-to” account online, which can take up to 5 business days to authenticate.

After that, it can take another 2 business days to receive the money in your account.

How To Transfer Gift Card Balances To Your Bank Account Using Raise

Yes, you can transfer money from most prepaid gift cards to your bank account using a service called Raise.

Unlike most prepaid cards, gift cards are limited. You can’t send money to another person and you can only use them at specific stores.

Most gift cards also have expiration dates, so you need to use them quickly so you don’t lose the money.

In addition, gift cards are disposable and can only be used until the balance reaches zero, while most prepaid cards are reloadable and can be used indefinitely.

Finally, the PayPal method and the USPS money order method we discussed above won’t work for gift cards because they don’t contain cash. What you have there are basically store credits, not actual money.

That’s where Raise comes in. It’s an online marketplace where you can buy, sell, and trade your gift cards at the best prices.

The catch? Don’t expect to cash out the full amount of your gift card.

You’re going to get bids for your gift card, so it’s impossible to determine the exact amount you can get since it all depends on what other people are willing to pay for.

So before you sell your gift card on Raise, make sure that it’s really the cash value that you want. Otherwise, you may want to just use it in your favorite store instead.

Follow these steps:

- Go to this page on the Raise website.

- List your gift card for sale in the Raise marketplace. You’ll need to input the store, gift card type, and amount.

- It can take up to 24 hours for gift card sale listings to be approved and verified.

- Wait for offers to come in.

- Once you receive an offer you like, accept it, and choose your preferred payment method.

- You can withdraw the money through your PayPal account or direct deposit.

Fees:

- It’s free to list a gift card for sale on Raise.

- Raise will take a 15% commission on every sale. This is based on the selling price, not the original gift card amount.

Note:There are certain brands and types of gift cards that Raise doesn’t accept. You can check the updated list here.

The Bottomline

The ability to transfer money from your prepaid card to your bank account will depend on the type of card you have. The best way to check whether your card has this feature is to check the customer service section of your prepaid card or gift card provider.

If transferring money to your bank account from your prepaid card is not available, you can try the options listed above such as using a money transfer service or mobile payment apps to move your money.

Did any of these methods work for you? What worked, and what didn’t? Let us know in the comments below!

Where is the Deposit option on the Money Gram site?