Social Security retirement benefits are available to American workers who have paid into the system throughout their working years. Originally established after the Great Depression, Social Security is a supplemental retirement program designed to ensure retired citizens have some level of income from which to live after they stop working.

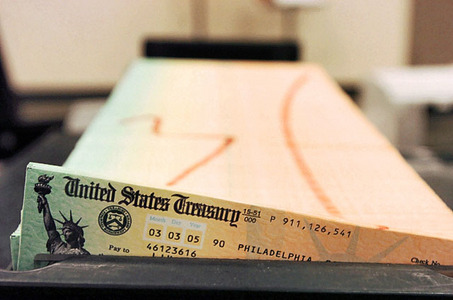

Social Security benefits make it possible for all individuals who have worked and paid into the Social Security fund to count on a benefit check that will provide income to cover living expenses and other financial needs once they are retired.

For many people Social Security is the only retirement benefit that they can count on, while others will add this income to distributions from other retirement accounts they have funded throughout the years. Here we take a closer look at some common questions asked about Social Security retirement benefits.

How old must you be to apply for benefits?

When you can apply for benefits will largely depend on your unique situation. The official retirement age is determined by the year in which a person was born.

For example, those born after 1960 have an official retirement age of 67. That being said, a person can begin receiving benefits when they are 62 years of age or at age 60 if they are a widow or widower who has not remarried.

How long does it take to get your first social security check?

It is recommended that individuals contact Social Security three months prior to the date they would like benefits to start to go over options available. Once an application for benefits has been submitted, the applicant can expect benefits to begin one month following their entitlement month.

If your entitlement date (the period when an individual meets the minimum age of retirement) is in July, your first social security check will arrive in August.

How do you apply for benefits?

When you are ready to apply for Social Security benefits, you can apply in a number of ways. For individuals living in the United States, applications can be taken over the phone, online or by visiting a local Social Security office.

Individuals who do not reside within the United States or any of its territories must contact the nearest U.S. Social Security office, Embassy or consulate.

Are there drawbacks to collecting early retirement?

It is recommended that any individual who is able to delay collecting Social Security until their retirement age do so. When you begin collecting early retirement (age 62) your benefit check will be less than if you had waited until your retirement year.

When considering what age to begin benefits it is very important to look at your own financial situation and needs to better determine if retiring early is an option that should be considered.

When it comes to Social Security retirement benefits, there are rarely questions that have a simple “one size fits all” answer. There are many factors that go into how much money you are entitled to, how much money you will receive and when.

You must also consider other sources of income and how that might affect your financial situation throughout retirement. One thing is certain for all individuals; retirement planning is very important to ensure maximum benefits and protection of assets which you will rely on for the remaining years.